The Gamification Of Finance: Trading, Betting, And Gaming

Executive Summary

The gamification of finance refers to the use of game elements and principles in financial products and services to encourage engagement, retention, and conversion. This emerging trend has the potential to transform the way people interact with and participate in financial markets by adding elements of fun, competition, and interactivity.

Introduction

Finance, traditionally known for its complexity and seriousness, is undergoing a unique transformation as it intersects with the world of gaming. The integration of game elements, such as point systems, rewards, and challenges, into financial activities has given rise to the concept of gamified finance. By incorporating these engaging features, financial activities become more interactive and incentivizing, attracting a broader range of participants and opening up new opportunities for growth and financial inclusion.

Subtopics

1. Trading

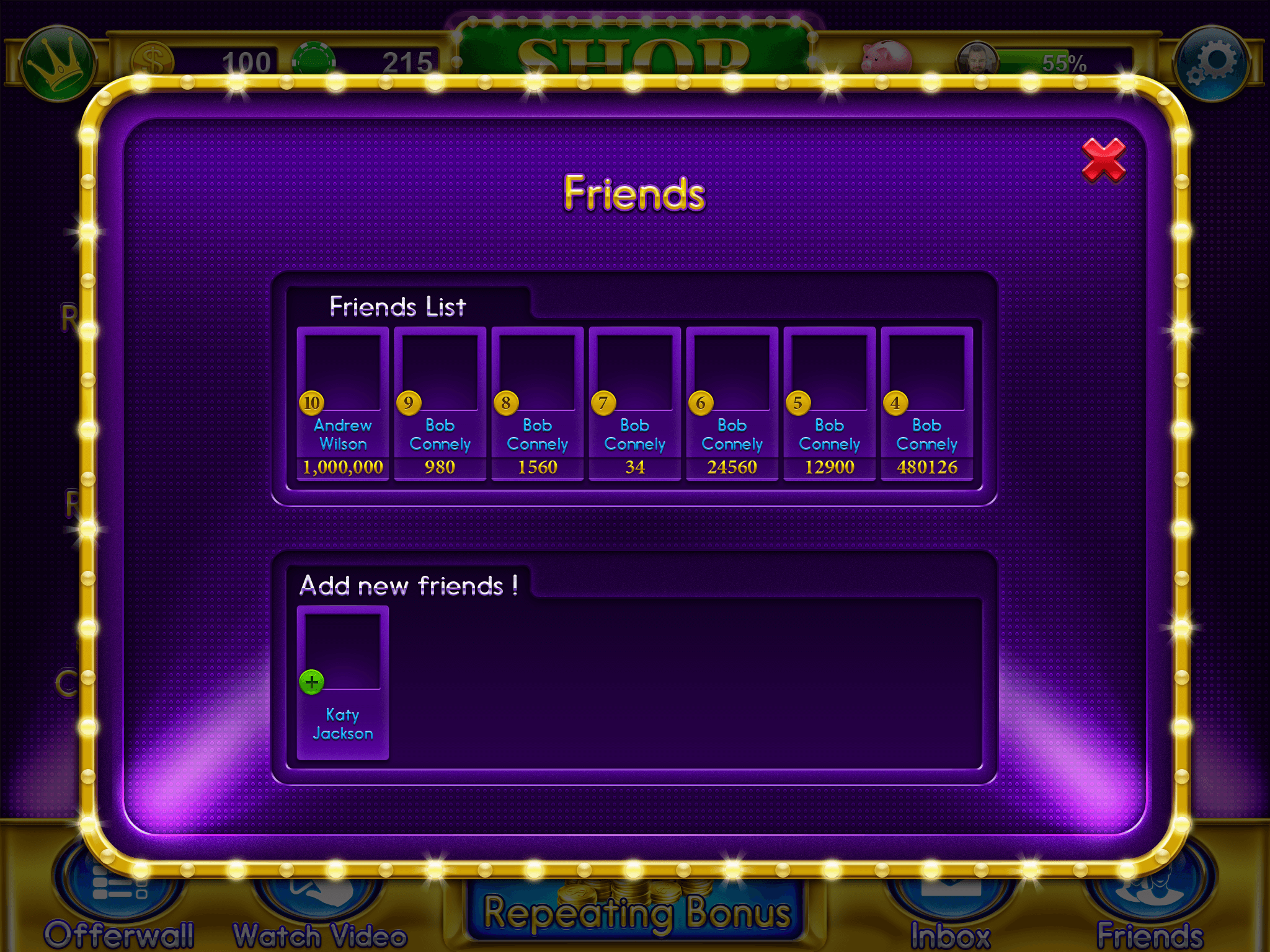

The gamification of trading platforms has injected excitement and engagement into an otherwise technical and analytical activity. Elements like virtual trading competitions, leaderboards, and the concept of badges and achievements enhance the user experience, turning trading into a dynamic game.

- Features:

- Virtual trading competitions: Traders compete against each other in simulated environments, with the opportunity to win virtual rewards.

- Leaderboards: Users can track their performance compared to others, creating a sense of friendly rivalry and motivation.

- Badges and achievements: Completing specific tasks or reaching milestones awards virtual badges or achievements, providing a sense of accomplishment.

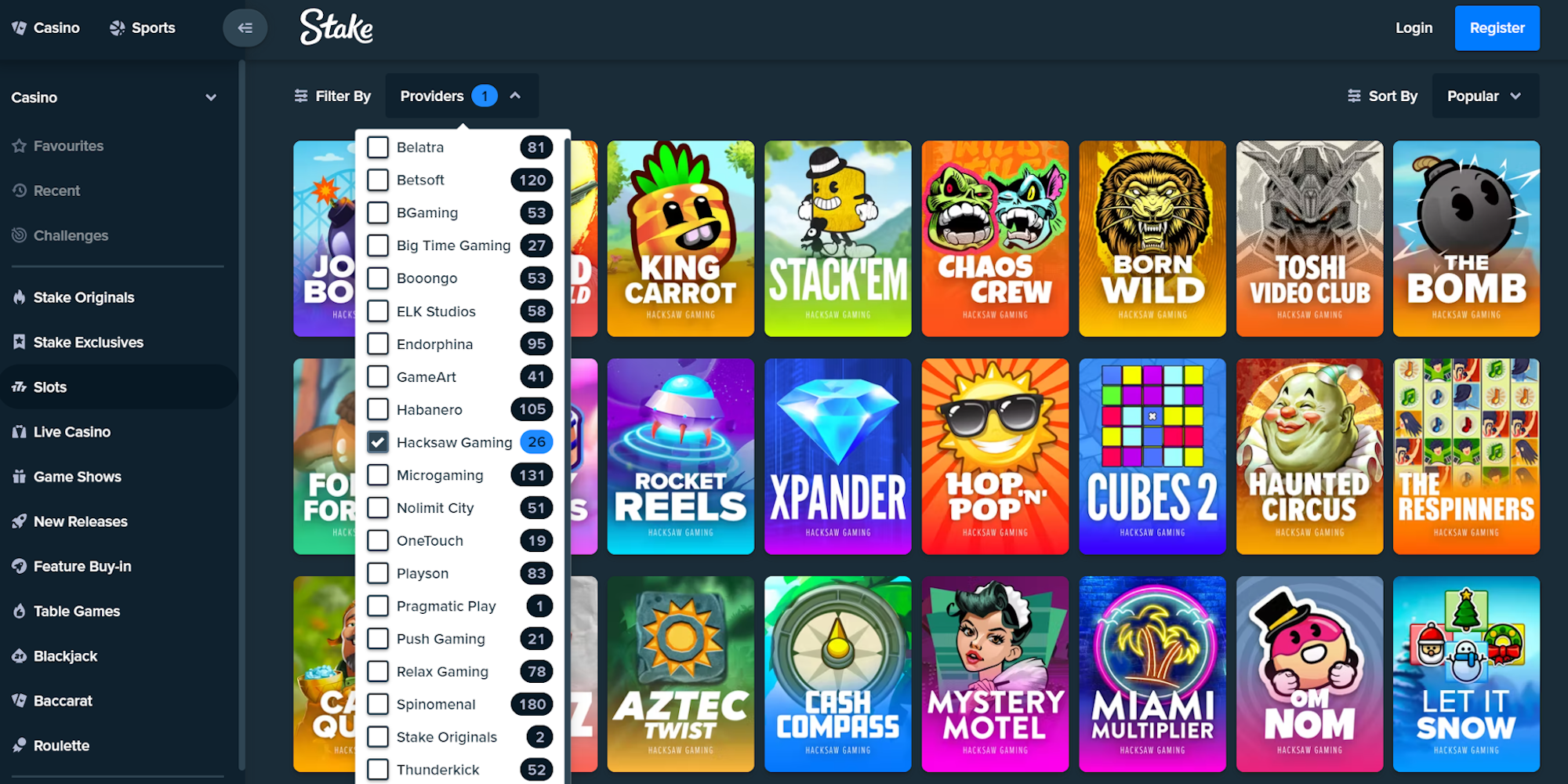

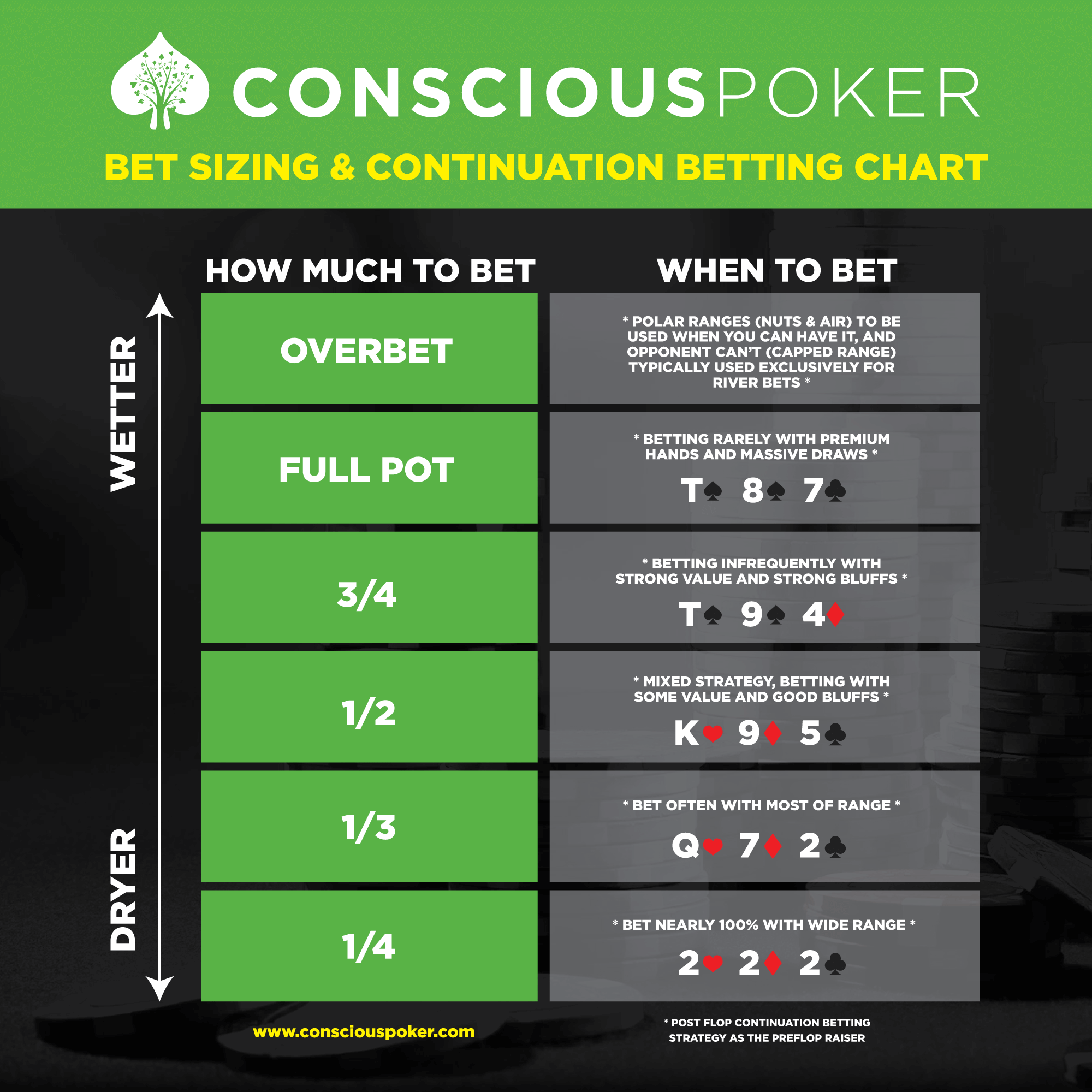

2. Betting

The worlds of finance and gambling have converged through the gamification of betting and speculative markets. Online platforms and applications make wagering on financial markets more accessible, allowing users to speculate on the movements of stocks, currencies, and commodities.

- Features:

- Simulated trading: Users can participate in simulated betting on real-world financial markets without risking actual capital.

- Virtual currencies: Platforms may use their own virtual currencies, allowing users to engage in risk-free or low-risk trading.

- Social features: Many platforms incorporate social elements, enabling users to interact, share strategies, and even wager against each other.

3. Challenges

Gamified financial products often incorporate challenges, which present users with specific tasks or goals to achieve. These challenges usually involve making certain trades, reaching certain levels of profitability, or unlocking specific badges and achievements.

- Features:

- Time-bound challenges: Users have a set period to complete challenges, adding an element of urgency and excitement.

- Multi-level challenges: Challenges may have multiple levels, each with increasing difficulty and rewards.

- Community-based challenges: Users can participate in challenges alongside other users, fostering a sense of competition and collaboration.

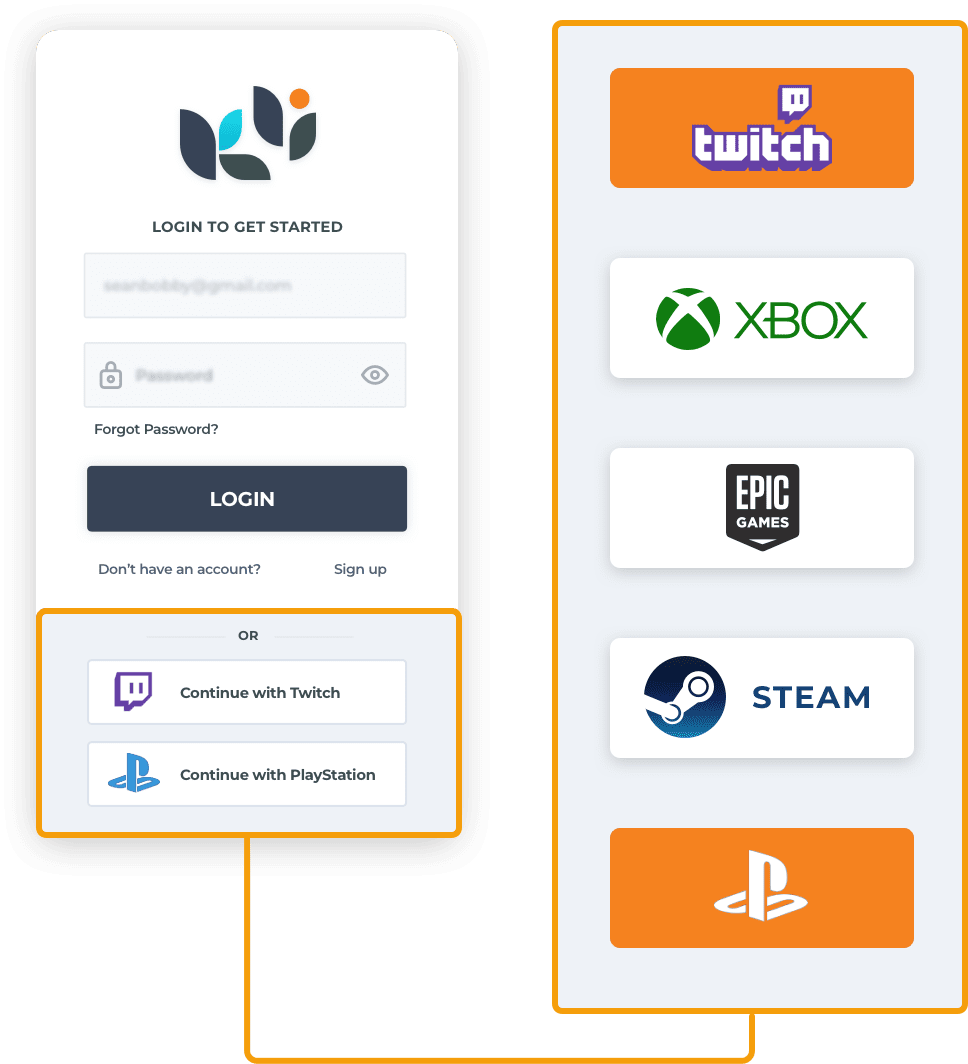

4. Social Trading

Gamified finance has fueled the growth of social trading platforms, where users can share their strategies, observe the trades of others, and even copy their investments. This concept adds a layer of interaction and learning to the financial experience.

- Features:

- Copy trading: Users can automatically copy the trades of more experienced or successful traders.

- Communities and forums: Platforms offer communities and forums where users can interact with each other, share insights, and discuss strategies.

- Leaderboards and rankings: Users can track their own progress and performance compared to other traders.

5. Investment Education

The gamification of finance also presents an opportunity for financial literacy and education. Platforms may incorporate interactive modules, tutorials, and quizzes to teach users about financial concepts, investing techniques, and risk management.

- Features:

- Interactive modules: Platforms offer interactive modules that introduce users to the basics of personal finance, investing, and risk management.

- Investment simulators: Users can practice investing in a safe and simulated environment, experimenting with different strategies and learning from their mistakes.

- Quizzes and assessments: Users can test their knowledge through quizzes and assessments, earning badges or unlocking new levels as they progress.

Conclusion

The gamification of finance is reshaping the financial landscape by injecting elements of engagement, fun, and competition into traditionally dry and complex activities. Gamified financial products and services have the potential to engage a broader audience, enhance financial literacy, and provide a more enjoyable and rewarding financial experience. As technology advances and platforms continue to innovate, the gamification of finance is likely to expand and revolutionize the way we interact with and participate in the financial markets.

Keyword Phrase Tags

- Gamification of Finance

- Trading

- Betting

- Social Trading

- Financial Literacy

Global Online Gambling & iGaming is a full service cash Online Gambling & iGaming marketing consultancy with casino partners situated around the world.

Global Online Gambling & iGaming is a full service cash Online Gambling & iGaming marketing consultancy with casino partners situated around the world.