The Art Of The Deal: Mergers And Acquisitions In iGaming

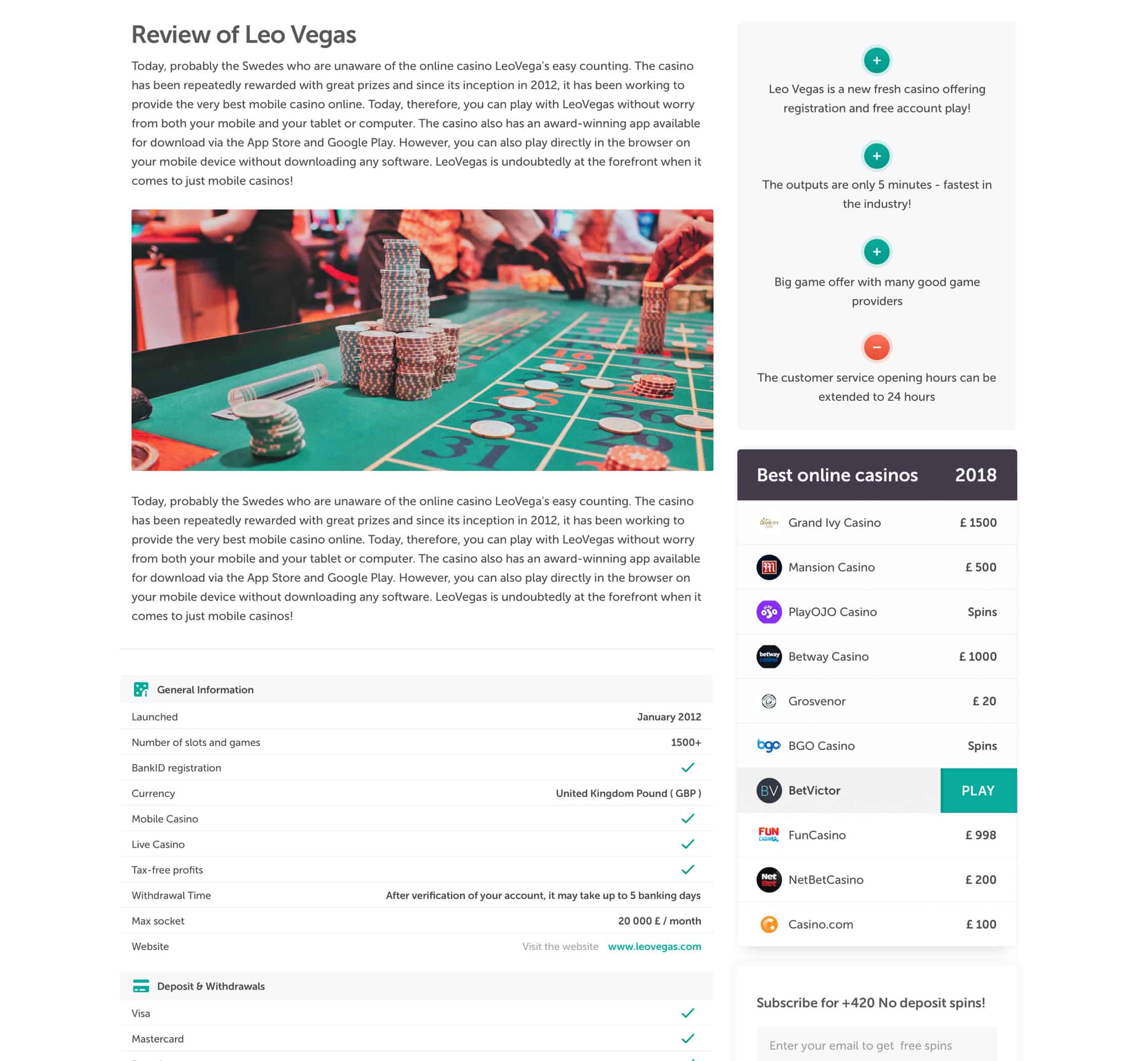

Mergers and acquisitions (M&A) have become increasingly common in the igaming industry, as companies look to expand their market reach, increase their customer base, and improve their overall efficiency. In recent years, there have been a number of high-profile M&A deals in the igaming industry, including the acquisition of Amaya Inc. by Stars Group for $4.9 billion in 2024, the merger of Ladbrokes and Coral in 2024, and the acquisition of bwin.party digital entertainment plc by GVC Holdings for £1.1 billion in 2024.

There are a number of factors that have contributed to the increase in M&A activity in the igaming industry. One factor is the growing popularity of online gambling, which has led to increased competition in the market. As a result, companies are looking to merge with or acquire other companies in order to gain a larger market share and increase their customer base.

Another factor that has contributed to the increase in M&A activity in the igaming industry is the increasing regulation of the industry. In recent years, many countries have introduced new regulations that make it more difficult for igaming companies to operate. As a result, companies are looking to merge with or acquire other companies in order to gain a stronger foothold in the market and increase their overall compliance with regulations.

Finally, the increasing availability of capital has also contributed to the increase in M&A activity in the igaming industry. In recent years, there has been a significant amount of money invested in the igaming industry, which has made it easier for companies to finance acquisitions and provide cash for acquisitions to shareholders.

The M&A landscape in the igaming industry is likely to continue to change in the years to come. As the industry continues to grow and evolve, companies will continue to look for opportunities to merge with or acquire other companies in order to gain a competitive advantage.

Here are some of the key trends that are likely to shape the M&A landscape in the igaming industry in the years to come:

- The increasing popularity of online gambling: The online gambling market is expected to continue to grow in the years to come, as more and more people are turning to online gambling for entertainment and recreation. This growth is likely to lead to increased M&A activity, as companies look to capitalize on the growing demand for online gambling.

- The increasing regulation of the industry: The increasing regulation of the igaming industry is likely to continue to have a major impact on the M&A landscape. As governments around the world introduce new regulations, companies will need to adapt in order to stay in compliance. This could lead to a consolidation of the market, as smaller companies are acquired by larger companies that have the resources to comply with the new regulations.

- The increasing availability of capital: The increasing availability of capital is likely to continue to fuel M&A activity in the igaming industry. As investors continue to pour money into the igaming industry, companies will have more opportunities to finance acquisitions and provide cash for acquisitions to shareholders.# The Art of the Deal: Mergers and Acquisitions in iGaming

Executive Summary

The global iGaming market has experienced unprecedented growth in recent years and is expected to continue expanding in the years ahead. This growth has been driven by a multitude of factors, including the increasing popularity of online gaming, the proliferation of mobile devices and more favorable regulatory environments. As a result of this growth merging and acquisitions has also seen an upsurge in the igaming industry. This article will explore the key considerations and challenges, as well as the potential benefits and pitfalls of mergers and acquisitions in the igaming sector.

Introduction

Mergers and acquisitions (M&A) have become increasingly common in the igaming industry as companies look to expand their market share, diversify their product offerings, and gain a competitive advantage. These transactions often have a profound impact on the industry landscape, leading to the consolidation of the market and the emergence of new industry leaders.

Key Considerations and Challenges

1. Strategic Fit

- Identifying Compatible Business Models: Ensuring that the merging companies have compatible business models, target markets and corporate cultures.

- Evaluating Synergies: Assessing the potential for cost savings, revenue enhancements, and market expansion opportunities.

- Understanding Competitive Dynamics: Analyzing how the deal will affect the entity's competitive advantage within the igaming landscape.

2. Regulatory and Compliance Risks

- Navigating Legal and Regulatory Complexities: Understanding and complying with the myriad of igaming regulations, taxation policies and restrictions.

- Managing Compliance Obligations: Ensuring that the merged entity can satisfy its ongoing regulatory obligations and licensing requirements.

- Addressing Cross-Border Issues: Understanding the legal and regulatory frameworks that govern cross-border M&A transactions.

3. Integration Challenges

- Managing Cultural Differences: Creating a cohesive corporate culture that aligns the values and strategies of the merging companies.

- Overcoming Integration Hurdles: Addressing potential issues related to system integration, technology infrastructure and employee retention.

- Ensuring Smooth Knowledge Transfer: Facilitating effective knowledge sharing and expertise transfer between the merging companies.

4. Debt Financing and Capital Structure

- Managing Financial Obligations: Structuring the M&A transaction in a way that manages debt and equity financing obligations effectively.

- Ensuring Financial Stability: Analyzing the impact of the acquisition on the acquirer's financial stability and credit rating.

- Maintaining Investor Confidence: Communicating the M&A transaction strategy clearly and transparently to investors and stakeholders.

5. Post-Merger Integration and Performance Management

- Performance Measurement: Establishing metrics and targets to measure the success of the M&A transaction.

- Continuous Monitoring: Regularly monitoring performance indicators and addressing deviations from expected outcomes.

- Agile Response to Challenges: Developing a contingency plan for addressing unforeseen challenges and making adjustments as needed.

Conclusion

Mergers and acquisitions in the igaming industry can be complex and challenging endeavouts but have the potential to drive growth, innovation, and expansion. To maximize the chances of success companies should conduct thorough due diligence, carefully consider the strategic fit, address regulatory and compliance risks, navigate integration challenges effectively and prioritize post-merger integration and performance management.

Keyword Phrase Tags

- igaming mergers and acquisitions

- igaming industry consolidation

- M&A in online gaming

- igaming regulatory compliance

- post-merger integration in igaming

Global Online Gambling & iGaming is a full service cash Online Gambling & iGaming marketing consultancy with casino partners situated around the world.

Global Online Gambling & iGaming is a full service cash Online Gambling & iGaming marketing consultancy with casino partners situated around the world.