Payment Pioneers: The Evolution of iGaming Banking

The iGaming industry has witnessed a remarkable transformation over the past few decades, with technological advancements playing a pivotal role in shaping its landscape. One of the most significant evolutions within this industry has been the emergence of specialized payment solutions tailored to meet the unique requirements of online gaming.

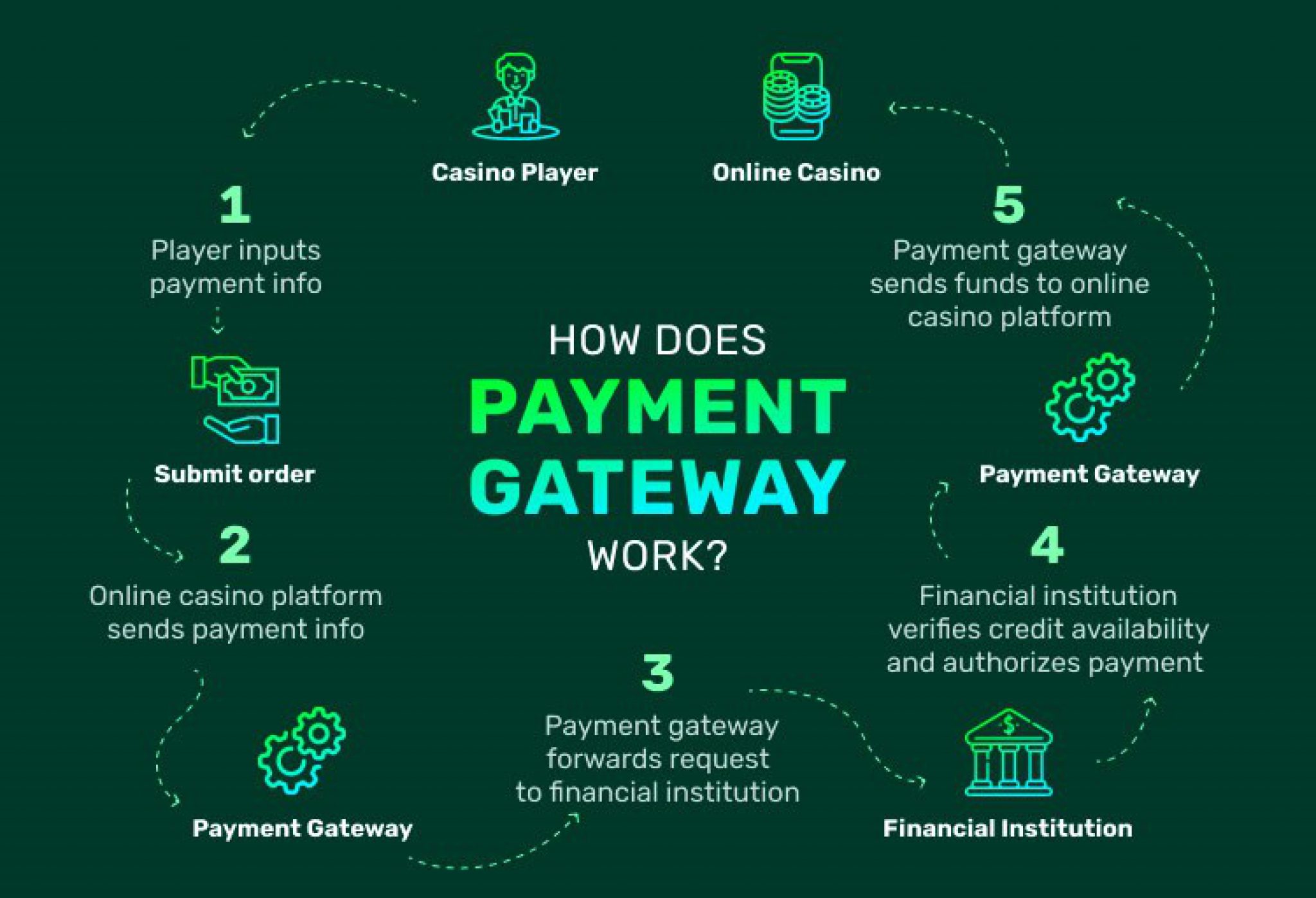

In the early days of iGaming, players faced limited payment options, often restricted to traditional methods such as credit cards and bank transfers. These methods posed several challenges, including high processing fees, slow transaction times, and potential security risks. As the industry expanded, the need for more efficient and secure payment solutions became increasingly apparent.

Recognizing this unmet demand, payment pioneers emerged, offering innovative solutions designed specifically for the iGaming sector. These pioneers, such as Neteller, Skrill, and PayPal, introduced a range of features that addressed the unique challenges of online gaming payments. They offered instant deposits, allowing players to fund their gaming accounts in real time, significantly enhancing the overall gaming experience.

Another key feature introduced by payment pioneers was the ability to accept multiple currencies. With players accessing iGaming sites from across the globe, it became essential to facilitate seamless transactions in various currencies. By offering multi-currency support, payment pioneers made it possible for players to deposit, withdraw, and play in their preferred currency, eliminating the need for costly currency conversions.

In addition to convenience and accessibility, payment pioneers placed a strong emphasis on security. Understanding the sensitivity of financial transactions in the iGaming industry, they implemented robust security measures to protect player data and ensure the integrity of payments. Features such as SSL encryption, two-factor authentication, and advanced fraud detection systems became standard practices, mitigating the risk of fraudulent activities.

As the iGaming industry continued to evolve, payment pioneers expanded their offerings to cater to the growing demands of the market. They introduced mobile-friendly payment solutions, enabling players to manage their gaming accounts and make transactions on the go. They also partnered with popular e-wallets and prepaid cards, providing players with a wider range of payment options to choose from.

The emergence of payment pioneers has played a transformative role in the iGaming industry, driving innovation and shaping the future of online gaming payments. By providing secure, convenient, and accessible payment solutions, these pioneers have not only met the evolving needs of the industry but have also contributed to its overall growth and success.Payment Pioneers: The Evolution Of iGaming Banking

Executive Summary

The iGaming industry has witnessed a rapid evolution in its banking methods, driven by advancements in technology and the need for secure, efficient, and convenient payment solutions. This article delves into the top five subtopics that have shaped the iGaming banking landscape, highlighting key considerations for operators and players alike.

Introduction

The iGaming industry has experienced exponential growth in recent years, propelling the need for innovative and reliable payment solutions. As technology continues to advance, new payment methods emerge, offering enhanced security, faster processing times, and greater convenience for players. This article explores the evolution of iGaming banking, focusing on the key subtopics that have transformed the industry.

1. Cashless Transactions

Cashless transactions have become increasingly popular in the iGaming industry, offering numerous advantages over traditional methods. Players benefit from the convenience of making payments without having to handle physical cash, reducing the risk of theft or loss.

- Mobile Payments: Mobile payment solutions allow players to deposit and withdraw funds using their smartphones or tablets, enhancing accessibility and convenience.

- Cryptocurrency: Cryptocurrencies like Bitcoin provide anonymity, low transaction fees, and fast processing times, making them a popular choice for many iGaming players.

- Prepaid Cards: Prepaid cards offer a convenient way for players to manage their iGaming expenses, without linking them to their personal bank accounts.

2. Enhanced Security Measures

Security is paramount in the iGaming industry, where players entrust operators with their personal and financial information. Advanced security measures have been implemented to protect player data and ensure fair play.

- KYC Compliance: Know-Your-Customer (KYC) regulations require operators to verify the identity of players to prevent fraud and money laundering.

- SSL Encryption: Secure Socket Layer (SSL) encryption protects player transactions and sensitive data from unauthorized access.

- Fraud Detection Systems: Sophisticated fraud detection systems detect and prevent suspicious activities, ensuring the integrity of the gaming experience.

3. Cross-Border Payments

The global nature of the iGaming industry demands便捷 of cross-border payments. Operators need to cater to players from different countries and currencies, making it essential for payment solutions to support international transactions.

- Currency Exchange: Currency exchange services enable players to deposit and withdraw funds in their local currency, eliminating currency conversion fees.

- Instant Withdrawals: Instant withdrawal options allow players to access their winnings quickly and easily.

- Multilingual Support: Payment providers with multilingual support make it easier for players to navigate the process in their preferred language.

4. Player Convenience

Player convenience is a key factor driving the evolution of iGaming banking. Operators prioritize payment methods that offer ease of use and accessibility for their customers.

- User-Friendly Interfaces: Payment platforms with user-friendly interfaces make it easy for players to navigate and complete transactions.

- 24/7 Support: Dedicated support teams are available to assist players with any queries or issues, providing peace of mind.

- Mobile Optimization: Mobile optimization ensures that payment processes can be carried out seamlessly on mobile devices.

5. Regulatory Compliance

The iGaming industry is subject to stringent regulatory requirements, which operators must adhere to ensure compliance. Payment solutions need to meet these regulations to maintain the integrity of the industry.

- License Verification: Payment providers must hold valid licenses from reputable regulatory authorities to operate within the iGaming sector.

- AML/KYC Compliance: All transactions must comply with anti-money laundering (AML) and KYC regulations to prevent financial crimes.

- Transparency and Reporting: Operators are required to maintain transparency and provide detailed reporting on financial transactions for regulatory purposes.

Conclusion

The evolution of iGaming banking has been shaped by the convergence of technological advancements, security concerns, and player demands. By incorporating cashless transactions, enhanced security measures, cross-border payments, player convenience, and regulatory compliance, payment solutions have revolutionized the way players deposit and withdraw funds in the iGaming industry. As technology continues to evolve, and regulations adapt to meet the changing landscape, the future of iGaming banking holds even more innovations and seamless payment experiences for players worldwide.

Keyword Phrase Tags:

- iGaming Banking

- Cashless Transactions

- Enhanced Security Measures

- Cross-Border Payments

- Player Convenience

Global Online Gambling & iGaming is a full service cash Online Gambling & iGaming marketing consultancy with casino partners situated around the world.

Global Online Gambling & iGaming is a full service cash Online Gambling & iGaming marketing consultancy with casino partners situated around the world.